Accolade provides insights into your loan portfolio's profitability, helping you make informed pricing decisions that are designed to benefit both your members and your credit union.

This simple formula reveals a lot about your credit union's financial health. The difficulty for most credit unions lies in quantifying related service costs across product lines and understanding the role credit risk plays in their cost to lend.

.png?width=200&height=200&name=lpp%20(1).png)

Credit risk exposure is unique to your membership. Our probability of default model forecasts credit risk with as little as an AIRES file and supplemental collateral value information.

Expenses and income vary significantly by product and should be reflected in loan pricing. Accolade advisors facilitate a study to allocate servicing expenses, fee income, and other expenses to different products.

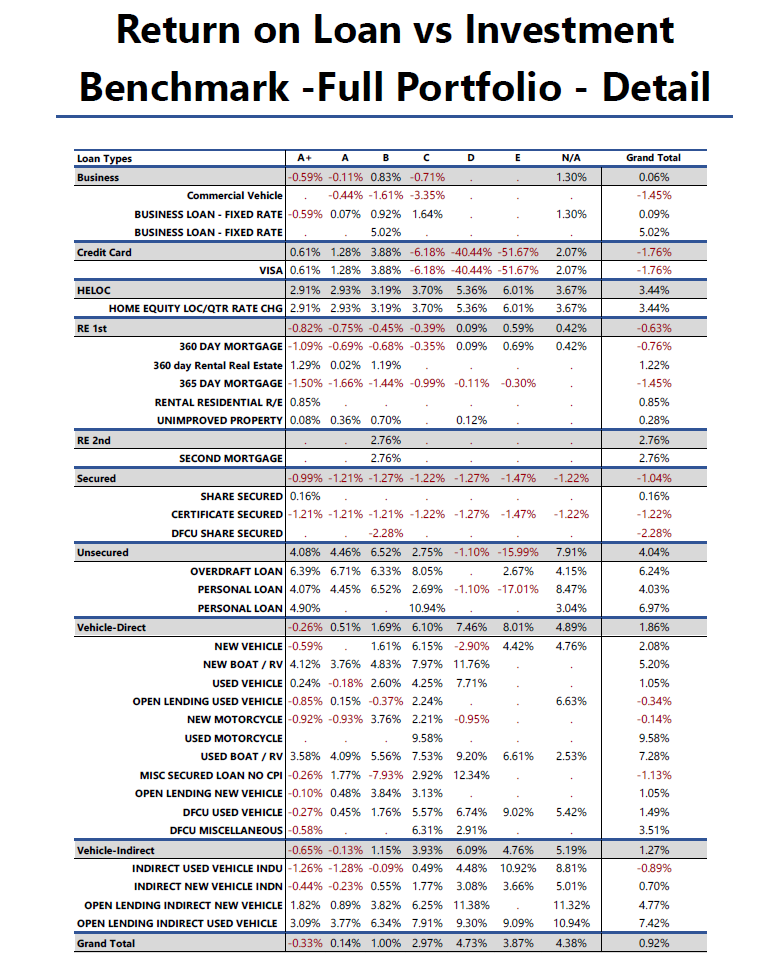

Once the model has determined net yield across credit tiers, customized investment benchmarks are used to determine if the loan offering meets strategic guidelines.

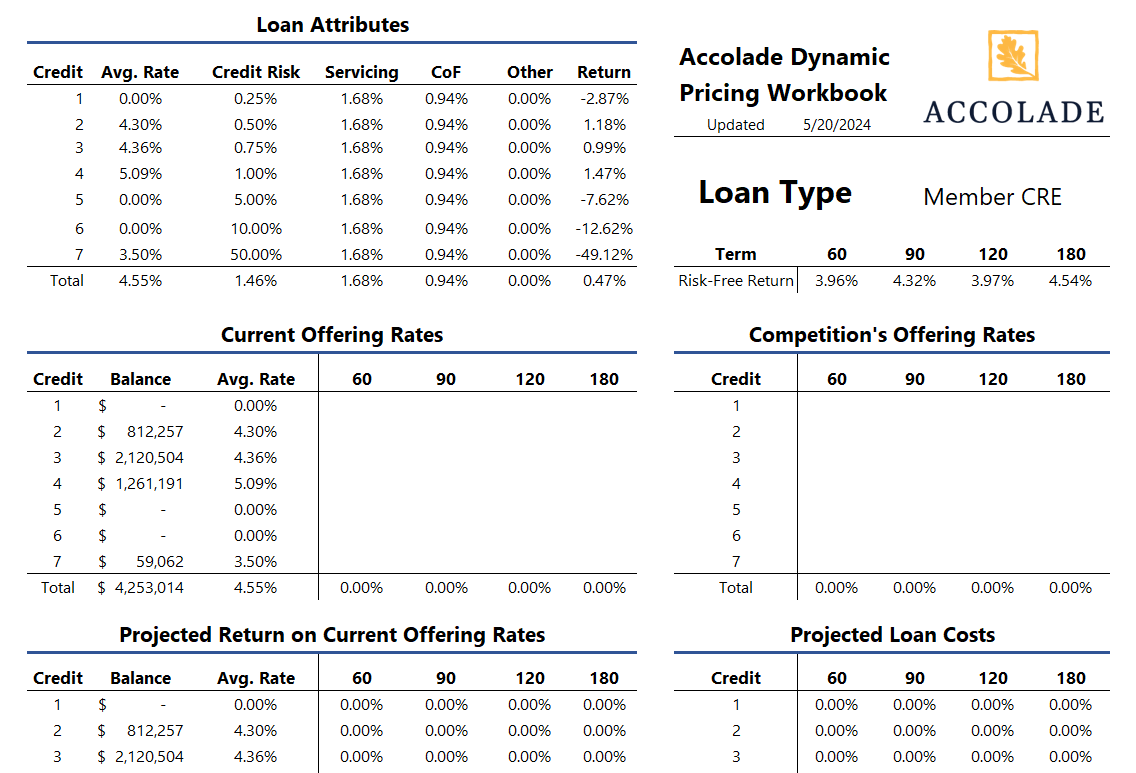

Test what-if pricing scenarios to compare competitor rates and consider price match requests.

View projected returns by product type and credit tier to help evaluate the efficacy of different products, identify underpricedand suggest opportunities for promotions.

There are inherent costs in lending that should be used to assess profitability. Credit risk, servicing expenses, cost of funds, and other expenses must be quantified to measure a net return. In many cases, lending costs will vary by product type and borrower risk profile, such as credit tier. Understanding these variations can help you determine where your efforts offer the most value.

Different types of loans should be evaluated net of expenses and compared to similar investments to evaluate opportunity cost. Once the loan pricing model has determined net yield across credit tiers and product types, we provide customized investment benchmarks to help determine if the loan offering meets strategic guidelines.

If a loan is underpriced management can adjust future pricing or assess the value of obtaining the member relationship. We can choose to make a loan at a lower return, but we had better know why we are doing it.

A rapidly changing interest rate environment has significantly impacted credit union cost of funds and loan pricing strategies. Loan rates should be updated at least monthly to account for changes in credit performance, cost of funds, and available investment alternatives. Accolade’s Dynamic Loan Pricing Workbooks can help you team quickly assess projected lending costs and yields when setting new loan rates, and our loan analytics model offers a forward-looking view of credit risk.