Establishing quantitative and environmental adjustments to your CECL reserve is a daunting task without looming recession, tariff wars, and stubbornly high inflation. You know your members are feeling the pressure of today’s economy, but where will it impact your loan portfolio?

Defining a Q-Factor

As a refresher, a quantitative and environmental adjustment, usually called a Q-factor, is an addition to or subtraction from your CECL calculation that accounts for risks not captured in the model. The WARM methodology used by most credit unions multiplies the historic net loss by the weighted average remaining maturity. This leaves a lot of room for adjustments since any current or future conditions that increase risk need to be accounted for with an adjustment. The NCUA states that there is no definitive guidance for what adjustments should be included or what the amount should be, but examples include changes in market conditions, lending strategy, loan volume, collateral values, etc. Their primary recommendation is to make “adjustments grounded in discernable observations or data”1.

The ambiguity around Q-factors is only worsened by the current narrative around the state of the economy. On one hand, the hard data, such as jobs numbers and unemployment stats, remain on solid footing. On the other hand, delinquencies and charge offs are on the rise, indicating some stress on the American household.

So how do you assess and justify Q-factors in your reserve calculation? While your management team and your auditor can help you assess the Q-factors for your institution, here are some examples where risk has increased on a national level.

Industry Trends

Auto Loans

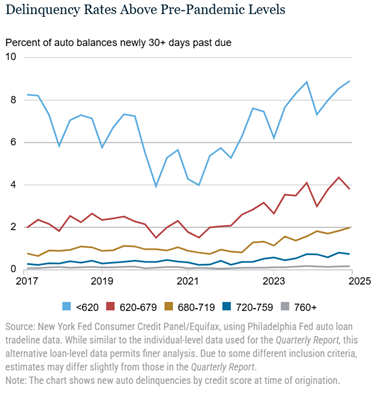

Everyone is talking about auto loans. Values, payments, and interest rates are all too high, creating a perfect storm for higher charge-offs. Unfortunately, the data supports this as delinquencies have been steadily increasing. We can see in the chart below from Fitch Ratings that auto delinquencies of 60+ days are at the highest they’ve been since the 90s2. Newly transitioned delinquencies are higher than even pre-pandemic levels3. While credit unions generally fare better than banks and other lenders, the NCUA’s Quarterly Data Summary Report revealed that delinquencies are up 15 basis points and charge offs are up 19 basis points from last year for federally insured credit unions4. This rising trend appears across income levels, ages, although loans opened between 2022 and 2023 seem to fare worse than other due to higher prices5.

Even if you haven’t seen an increase in charge-offs or have historically higher recoveries, the broader industry trends point to greater risk in this category.

Credit Cards

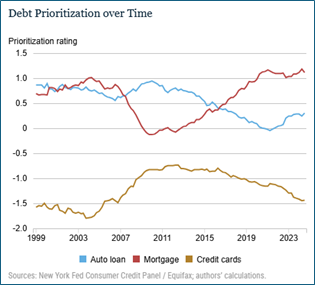

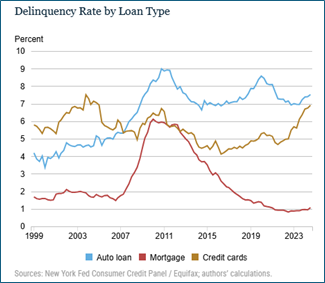

People can make choices about what they pay and where they fall behind. The New York Fed’s recently published an article analyzing data from New York Fed Consumer Credit Panel to determine what types of loans consumers are prioritizing when they can’t afford to pay everything6. The charts below show credit card payments are the last priority for struggling families.

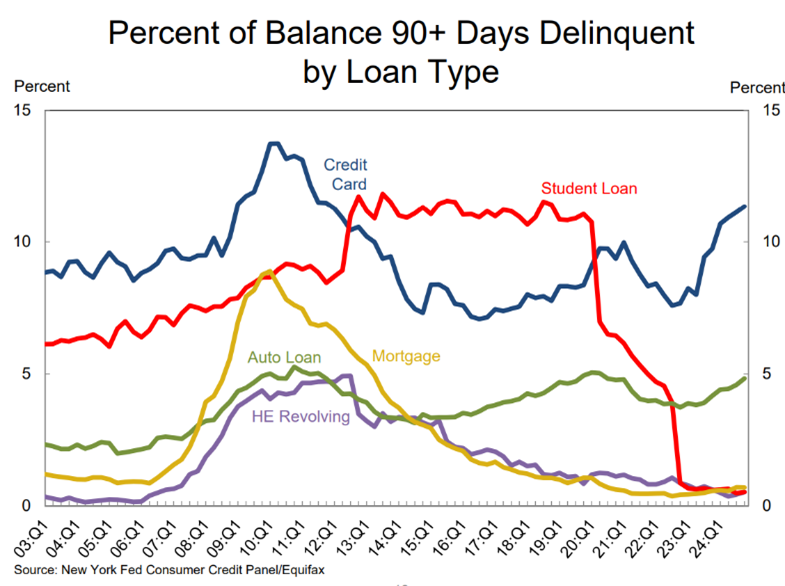

This is further supported by the New York Fed’s Q4 Household Debt and Credit Report that show the majority of loans 90+ days delinquent are credit cards7.

The unsecured nature of credit cards combined with the concerning rise of delinquencies indicate that risk is rising in this category.

Mortgages

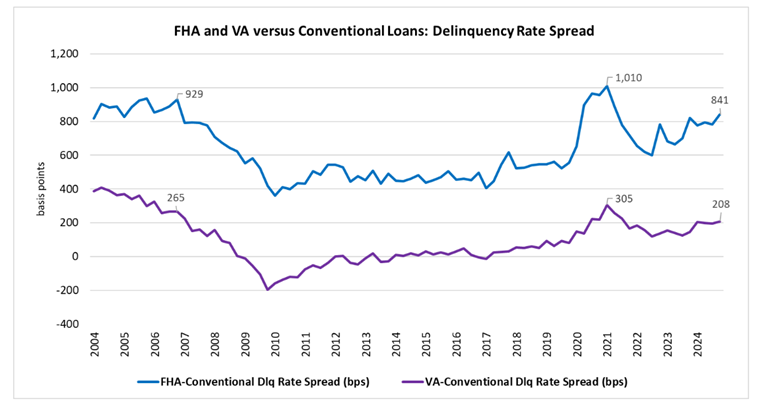

Interestingly mortgages have not been hit quite as hard as other loan types. We saw in the charts above that mortgage payments are prioritized above other types of debt, and they didn’t see as high of an increase in delinquencies over the last year, although they did increase8. Delinquencies on conventional loans increased by only 1 basis point over 2023, but they increased by 22 basis points for FHA loans and 63 basis points for VA loans8.

The risk you assess on your mortgages therefore depends on the makeup of your portfolio. If you have a higher concentration of government loans, then you may need to consider a more aggressive Q-factor than a neighboring credit union with more conventional loans.

Other Factors to Consider

The above data is a broad perspective on increased risk to lenders, but it is far from comprehensive. To ensure that your Q-factors are providing adequate coverage (without inflating your reserves too much), you need to analyze this type of data through the lens of your institution. Membership, portfolio composition, LTV ratios, region, and SEG, among innumerable other factors, will impact the degree to which your credit union experiences risk.

- “Simplified CECL Tool Frequently Asked Questions.” 2025. NCUA. January 23, 2025. https://ncua.gov/regulation-supervision/regulatory-compliance-resources/cecl-resources/simplified-cecl-tool/faqs.

- Fitch Ratings

- Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw, "Breaking Down Auto Loan Performance," Federal Reserve Bank of New York Liberty Street Economics, February 13, 2025, https://libertystreeteconomics.newyorkfed.org/2025/02/breaking-down-auto-loan-performance/.

- National Credit Union Administration. 2024. “Quarterly Credit Union Data Summary.” https://ncua.gov/files/publications/analysis/quarterly-data-summary-2024-Q4.pdf.

- Andrew F. Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, Wilbert van der Klaauw, and Crystal Wang, “Auto Loan Delinquency Revs Up as Car Prices Stress Budgets,” Federal Reserve Bank of New York Liberty Street Economics, February 6, 2024, https://libertystreeteconomics.newyorkfed.org/2024/02/auto-loan-delinquency-revs-up-as-car-prices-stress-budgets/

- Jacob Conway, Natalia Fischl-Lanzoni, and Matthew Plosser, “When the Household Pie Shrinks, Who Gets Their Slice?,” Federal Reserve Bank of New York Liberty Street Economics, March 6, 2025, https://libertystreeteconomics.newyorkfed.org/2025/03/when-the-household-pie-shrinks-who-gets-their-slice/.

- Center for Microeconomic Data. 2025. “Quarterly Report on Household Debt and Credit.” Federal Reserve Bank of New York. https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q4.

- Taylor, Falen. “Mortgage Delinquencies Increase in the Fourth Quarter of 2024.” Web log. Mortgage Bankers Association (blog), February 6, 2025. https://www.mba.org/news-and-research/newsroom/news/2025/02/06/mortgage-delinquencies-increase-in-the-fourth-quarter-of-2024.